|

Charlotte Stonestreet

Managing Editor |

More robots are coming

17 October 2017

In the middle of September I visited Rittal at Herborn near Frankfurt in Germany (see page 48) and was fortunate that it coincided with the launch by the International Robotics Federation (IFR) of its "World Robotics Report - industrial robots - outlook 2020."

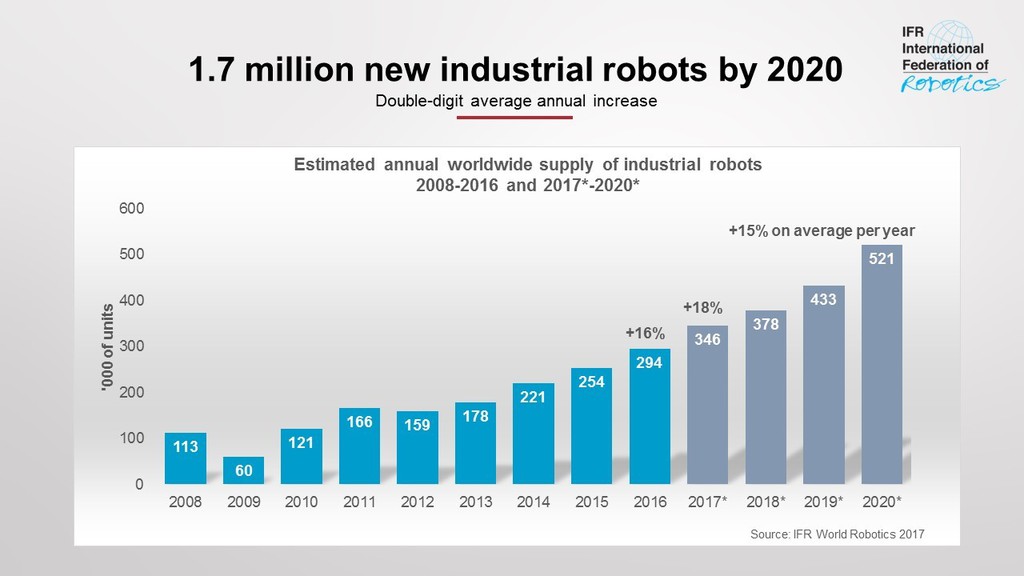

According to the IFR, by 2020 - that is no more than two to three years away - more than 1.7 million new industrial robots will have been installed in factories around the world. Today, the strongest growth in the robotics industry is in Asia – led by China as the world´s number one marketplace.

In terms of units, it is estimated that by 2020 the worldwide stock of operational industrial robots will increase from about 1,828,000 units at the end of 2016 to 3,053,000 units. This represents an average annual growth rate of 14% between 2018 and 2020.

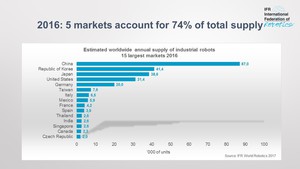

China has significantly expanded its leading position as the largest market (with South Korea second) with a share of 30 percent of the total supply in 2016. With sales of about 87,000 industrial robots China came close to the total sales volume of Europe and the Americas combined (97,300 units). Chinese robot suppliers continued to expand their home market share to 31% in 2016.

Important drivers of this development are faster business cycles and greater flexibility. Robots can work around the clock, offer high levels of precision and improve worker health and safety by performing dangerous and unergonomic tasks.

As system complexities and data incompatibility are overcome, manufacturers will integrate robots into factory-wide networks of machines and systems. Analysts predict a rapidly growing market for cloud robotics in which real-time data collected by sensors attached to robots is compared to data from other robots in the same or different locations. Ultimately, the advent of big data in manufacturing could redefine the industry boundaries between equipment makers and manufacturers.

"Robots offer high levels of precision and their connectivity will play a key role in new digital manufacturing environments,” says IFR President Joe Gemma. “Increasing availability enables more and more manufacturers from companies of all sizes to automate.”

With a density of 1,261 installed robots per 10,000 employees, the United States ranked second in 2016 after the Republic of Korea. Germany is the fifth largest robot market in the world and by far the largest in Europe. The annual supply and operational stock of industrial robots in 2016 had a share of 36% and 41% respectively of total robot sales in Europe.

And in the UK? How much are we investing in order at least to keep the productivity of our regional and international competitors in sight? According to other sources, our investment in robotics is the lowest of the major European economies and we rank just above Thailand in the population of robots per 10,000 employees.

- Build it & they will come

- Sleepwalking

- Green technology: what the Government giveth, so Brexit taketh away

- Funding - what funding?

- The road to zero overtime

- A symbol of hope

- Brexit: You were only supposed to blow the bloody doors off!

- Maintec: dialogue the key to networking

- Overcoming the Iceberg Effect

- Meet us at MACH

- No related articles listed